As one of the world’s largest economies and a global financial hub, the United Kingdom’s financial future trends is a topic of great interest to businesses and investors alike. With Brexit looming and a changing global economic landscape, keeping a close eye on the UK’s financial trends and predictions is crucial for those looking to make informed decisions. From stock market fluctuations to interest rates and fiscal policies, there are many factors that will impact the UK’s financial future. In this article, we will delve into some of the latest insights and predictions from experts in the field, providing you with a comprehensive overview of what to expect in the coming months and beyond. So, whether you’re a business owner, investor, or simply interested in staying up-to-date with the latest financial news, read on to discover the key trends and predictions that could shape the United Kingdom’s financial future.

1.Current economic situation in the UK

The United Kingdom’s economy has been facing significant challenges in recent years. The country has been grappling with the impact of Brexit, which has led to uncertainty in the business world. The COVID-19 pandemic has also disrupted the economy, with businesses struggling to stay afloat during the lockdowns. The UK’s GDP contracted by 7.8% in 2020, which is the largest decline in 300 years.

Despite the challenges, there are some positive signs in the UK’s economy. The unemployment rate has been falling, and it is now at 4.8%. The Bank of England has also predicted that the UK’s economy will grow by 7.25% in 2021, which would be the fastest growth rate in over 70 years. However, there are still many uncertainties, and the UK’s economic recovery will depend on various factors.

2.Factors affecting the UK’s financial future – Brexit, COVID-19, and global economic trends

Brexit is one of the most significant factors that will impact the UK’s financial future. The UK left the European Union on January 31, 2020, and there has been ongoing uncertainty about the future relationship between the UK and the EU. The UK and the EU have been negotiating a trade deal, and the outcome of these negotiations will have a significant impact on the UK’s economy.

The COVID-19 pandemic has also had a profound impact on the UK’s economy. The pandemic has led to lockdowns, which have forced many businesses to close their doors. The UK government has provided financial support to businesses and individuals, but there are concerns about the long-term impact of the pandemic on the economy.

Global economic trends will also impact the UK’s financial future. The world is facing an economic downturn, and this will have a ripple effect on the UK’s economy. The UK’s financial sector is closely linked to the global economy, and any shocks in other parts of the world will impact the UK.

3.Key trends and predictions for the UK’s financial future

There are several key trends and predictions for the UK’s financial future. One of the most significant trends is the shift towards a cashless society. The pandemic has accelerated this trend, with many people now using contactless payments and online banking. This trend is expected to continue, and it will have a significant impact on the financial industry.

Another trend is the rise of sustainable finance. There is increasing demand for sustainable and ethical investments, and this trend is expected to continue. The UK government has also set a target of achieving net-zero carbon emissions by 2050, and this will drive investments in renewable energy and other sustainable industries.

Interest rates are also a key factor that will impact the UK’s financial future. The Bank of England has kept interest rates at a historic low of 0.1% to help support the economy during the pandemic. However, there are concerns that low-interest rates could lead to inflation and other economic challenges.

4.Changes in consumer behavior and their impact on the financial industry

The pandemic has led to significant changes in consumer behavior, and this will have a lasting impact on the financial industry. Consumers are now more focused on saving money and reducing debt, and this has led to a decline in consumer spending. The rise of e-commerce has also had a significant impact on the retail industry, with many traditional brick-and-mortar stores struggling to stay afloat.

The financial industry will need to adapt to these changes in consumer behavior. There will be a greater emphasis on digital banking and online services, and businesses will need to invest in new technologies to stay competitive.

5.The role of technology in shaping the UK’s financial future

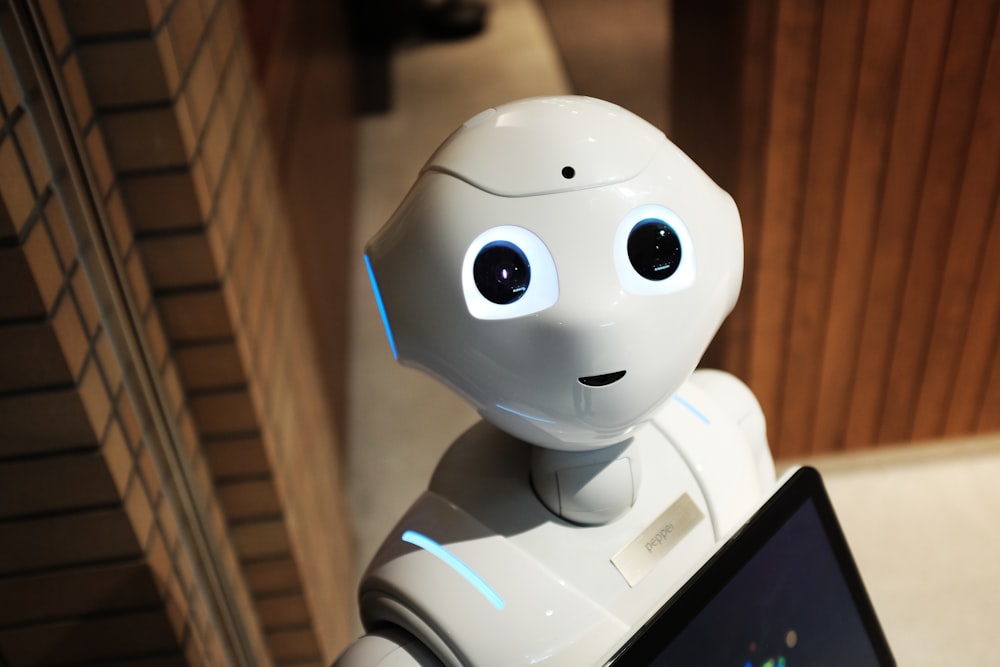

Technology will play a significant role in shaping the UK’s financial future. The rise of fintech has disrupted the financial industry, with new players entering the market and offering innovative products and services. The use of artificial intelligence and blockchain technology is also expected to increase, which will lead to greater efficiency and transparency in the financial industry.

However, there are also concerns about the impact of technology on jobs and the wider economy. The rise of automation and robotics could lead to job losses in certain sectors, and it will be essential to ensure that workers are reskilled to meet the demands of a changing economy.

6.Challenges and opportunities for businesses and investors in the UK

The UK’s financial future presents both challenges and opportunities for businesses and investors. Brexit and the pandemic have created a challenging business environment, but there are still opportunities for growth and innovation. The rise of sustainable finance and the shift towards a cashless society present new opportunities for businesses and investors.

However, it will be essential for businesses and investors to stay informed about the latest trends and predictions in the financial industry. The UK’s financial future is uncertain, and it will be important to make informed decisions based on the latest data and insights.

7.Expert opinions on the UK’s financial future

There are many experts in the financial industry who have shared their opinions on the UK’s financial future. The Bank of England has predicted that the UK’s economy will recover quickly in the coming years, but there are still many uncertainties. The International Monetary Fund (IMF) has also warned that the UK could face a long-term economic scarring if the pandemic continues to disrupt the economy.

Some experts have also warned about the impact of Brexit on the UK’s financial future. The UK and the EU have been negotiating a trade deal, and there are concerns that a no-deal Brexit could lead to significant economic disruption.

8.Steps businesses and individuals can take to prepare for the future

To prepare for the future, businesses and individuals can take several steps. It is essential to stay informed about the latest trends and predictions in the financial industry, and to make informed decisions based on this information. Businesses should invest in new technologies and stay ahead of the curve to remain competitive.

Individuals should also take steps to protect their finances, such as reducing debt and saving money. It is also important to invest in sustainable and ethical investments to support a more sustainable future.

Conclusion

The United Kingdom’s financial future is uncertain, with many challenges and opportunities ahead. Brexit, COVID-19, and global economic trends will all impact the UK’s economy, and it will be essential to stay informed about the latest trends and predictions. The rise of sustainable finance, the shift towards a cashless society, and the role of technology will all play a significant role in shaping the UK’s financial future. Businesses and individuals can take steps to prepare for the future and to make informed decisions based on the latest data and insights.